Established in 1959

Chula Vista Auto Insurance

Whether your car is parked or on the move, make sure you’re covered at all times. While we try to keep our vehicles safe, there’s no guarantee that others around us will do the same. At Hoffman Hanono, we match you with the right auto insurance that goes beyond just accident coverage.

The Best Premiums for Your Needs

Account for all risks and choose the most comprehensive coverage for you, your vehicle and your passengers. Our partner carriers provide the following:

- Liability coverage for bodily injury and property damage

- Personal injury protection

- Collision coverage

- Comprehensive coverage for vehicle theft or vandalism

Comprehensive Auto Insurance Coverage in Chula Vista

Finding the right auto insurance in Chula Vista isn’t just about meeting California’s minimum requirements—it’s about personalizing your policy to fit your lifestyle, driving habits, and personal risk tolerance. At Hoffman & Hanono, we offer auto insurance packages for Chula Vista drivers who need policies tailored to their exact needs:

Liability Insurance

Required by California law, liability insurance protects your finances if you cause bodily injury or property damage. You should know that as of January 1, 2025, California’s minimum liability limits for auto insurance policies have increased:

- $30,000 for bodily injury or death per person (up from $15,000)

- $60,000 for bodily injury or death per accident (up from $30,000)

- $15,000 for property damage per accident (up from $5,000)

This means that if you’re carrying the old minimum coverage limits, you’ll need to update your policy to comply with the new California law.

While these increased limits provide more robust protection, many Chula Vista auto insurance policyholders need increased protection.

Personal Injury Protection (MedPay)

In other states, drivers may carry personal injury protection (PIP) insurance, a “no-fault” policy that protects policyholders regardless of who causes the injury or property damage. While PIP insurance is not available in “at-fault” states like California, Chula Vista car insurance policyholders may choose to carry MedPay insurance, an optional policy that:

- Covers medical bills and funeral expenses for you and passengers, regardless of fault

- Provides coverage if you are injured as a pedestrian, passenger, or while using public transportation

- Pays out quickly, without a deductible or copay

MedPay can be a smart investment, particularly for drivers who do not have health insurance coverage or need more robust protection.

Collision Coverage

Limited liability insurance covers damage to others, but it does not pay for repairs to your vehicle. This is where collision coverage kicks in.

In California, collision coverage is optional—unless you are financing or leasing a vehicle. In such cases, most lenders require you to carry it. Many Chula Vista auto insurance policyholders choose collision coverage for peace of mind, knowing they are protected against costly repairs after an accident.

Comprehensive Coverage

Comprehensive coverage protects Chula Vista car insurance policyholders against unexpected events—whether it's theft, a fallen tree, or damage caused by a weather-related event. If you lease or finance your vehicle, lenders will likely require you to carry comprehensive coverage.

However, many Chula Vista car insurance policyholders opt for comprehensive coverage even if their vehicle is paid off. Not only does it provide peace of mind, but it also protects your investment when life throws you an unexpected challenge.

Finding the Right Auto Insurance in Chula Vista, CA

Every driver in Chula Vista has unique auto insurance needs. If you’re unsure which coverage options best suit your lifestyle and risk tolerance, consider the following:

- Daily commuters: If you travel Chula Vista's busy roads and highways every day, consider higher liability limits beyond California requirements. That, along with comprehensive and collision coverage, gives you peace of mind, knowing you're protected from unexpected events.

- Remote workers: If you spend most of the week at home, you may qualify for low-mileage discounts on your auto insurance in Chula Vista. However, it is still important to maintain adequate liability coverage, even if you are an occasional driver.

- Families with new drivers: Whether you are a new driver or have a child who is learning to drive, we recommend increasing limits on basic liability auto insurance in Chula Vista. Also, consider combining basic coverage with collision and MedPay to maximize protection.

- Luxury vehicle drivers: Protect your valuable investment with comprehensive and collision coverage to maximize protection against theft, vandalism, and accidents.

- Budget-conscious drivers: While you are legally required to carry limited liability auto insurance in Chula Vista, our agents will work with you to balance liability limits with your budget—without compromising your essential protection.

Trusted & Time-Tested Solutions

50+ Years Experience

Serving San Diego since 1959. We’re still family-owned and customer-focused.

All Lines of Insurance

We provide you with the most comprehensive coverage at a competitive cost.

Quality Service

We are dedicated to bringing you reliable and top-notch customer service.

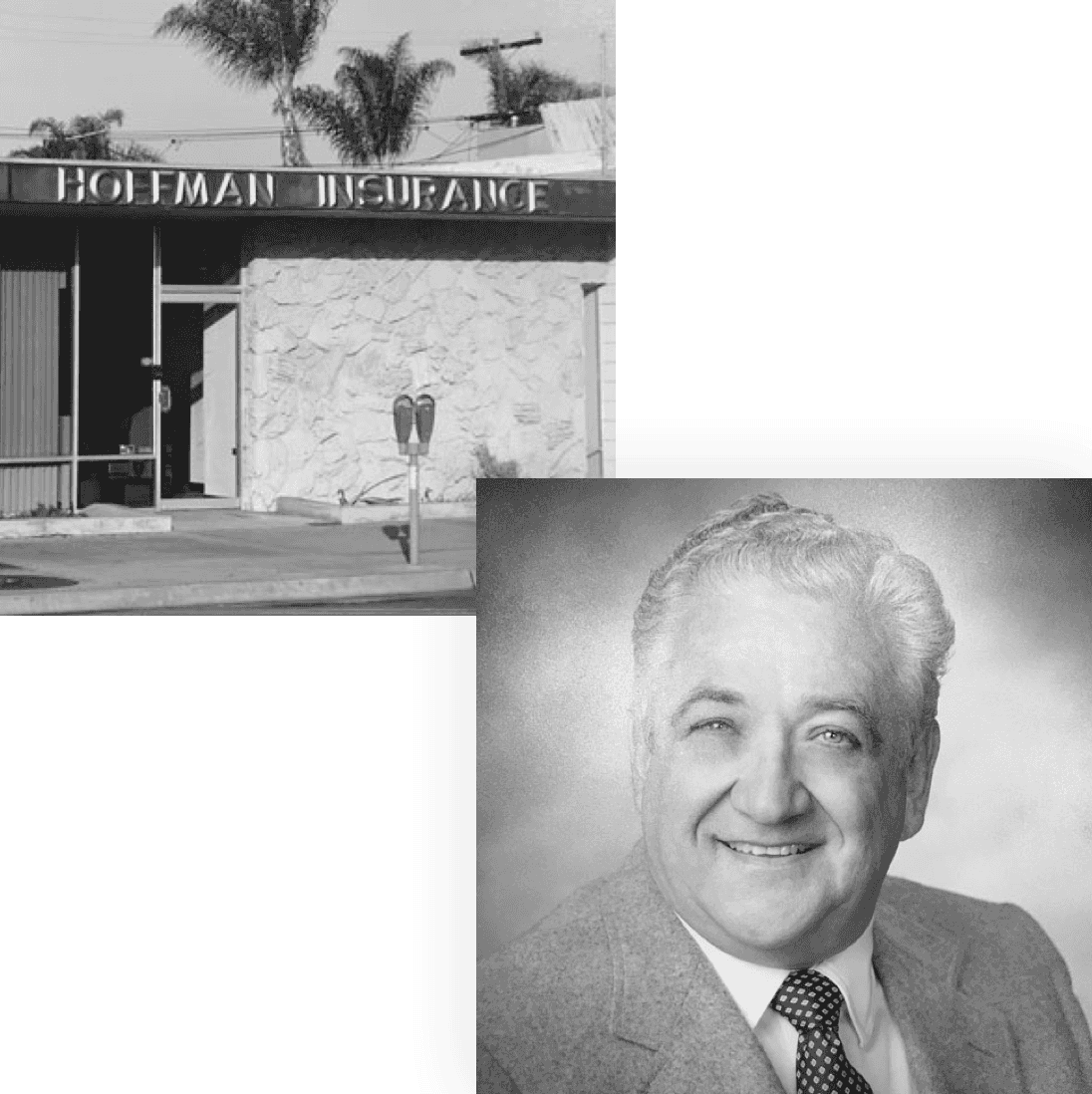

First-Class Service Since 1959

The story of our commercial insurance company starts with founder Jerry Hoffman, who aimed to offer cost-effective insurance solutions, superior customer service, and ultimately, peace of mind. Since then, the company has been passed down generations without losing our founder’s commitment.

Learn MorePeace of mind is priceless.

Let us help you get the right coverage for the right price.

Get a quote today!