Building Insurance in California

Protect what’s likely the largest physical asset of your business—the building and the land surrounding it. Building insurance coverage is critical for anyone who owns a building in California or is planning to purchase one. It needs to be in place in the event the worst happens.

What It Covers

Building insurance protects you if a fire, flood, earthquake, storm, theft, or vandalism occurs on your property. It covers the physical building and the property it sits on. We offer different types of building insurance plans and packages, and we’ll pair you with trusted insurance providers to ensure you have a strong policy. Typically, a policy will cover damage to:

- Buildings

- Structures

- Fixtures

- Garages

- Fences

Custom Solutions

Our Builder’s Risk Insurance Approach

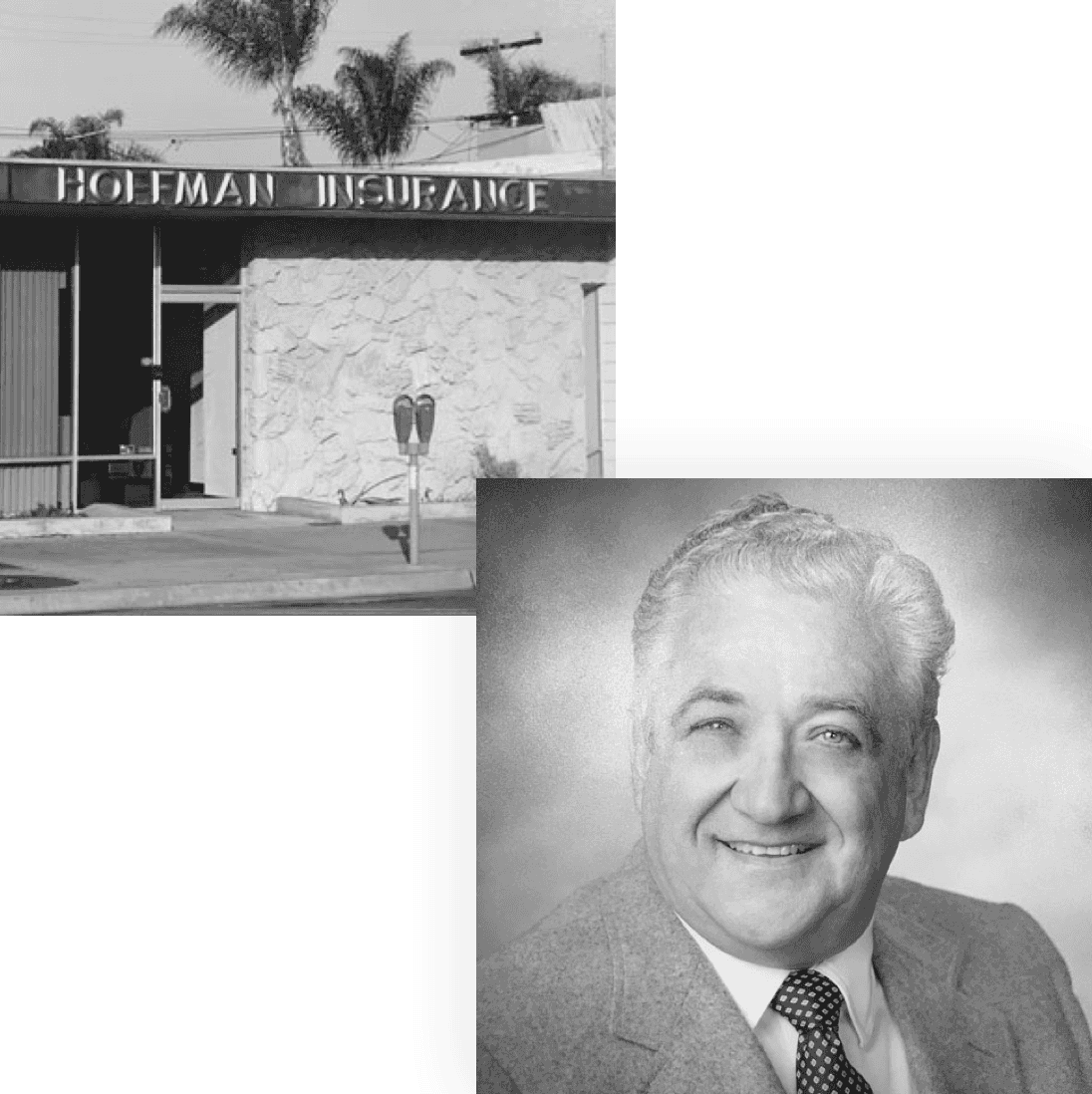

Hoffman Hanono Insurance Services is here to advise and partner with you to ensure you get the right building insurance for your California project. We specialize in finding insurance solutions meant entirely for you—because we know that insurance is not "one-size-fits-all." We provide quality service and resources that will help you secure better insurance premiums in the long run. Our commitment has made us a pillar of the San Diego and Chula Vista insurance community since 1959.

Trusted & Time-Tested Solutions

50+ Years Experience

Serving San Diego since 1959. We’re still family-owned and customer-focused.

All Lines of Insurance

We provide you with the most comprehensive coverage at a competitive cost.

Quality Service

We are dedicated to bringing you reliable and top-notch customer service.

Building Insurance FAQs

1. What is building insurance?

Building insurance protects the physical structure of your property, including the land it sits on. It is essential for property owners in California to safeguard against loss or damage from events such as fire, flood, earthquake, storm, theft, or vandalism.

2. Who needs building insurance in California?

Anyone who owns a building, is purchasing one, or has a commercial or residential project in California can benefit from building insurance. It ensures your property and surrounding assets are protected against unexpected risks.

3. What does building insurance typically cover?

Building insurance generally covers the main building, additional structures, fixtures, garages, fences, and any other property attached to the insured premises. Policies are tailored to fit each client’s unique needs.

4. How does Hoffman Hanono approach building insurance?

Hoffman Hanono partners with clients to provide customized building insurance solutions. We evaluate each property, match you with trusted insurance providers, and help you secure comprehensive coverage while optimizing premiums.

5. Why choose Hoffman Hanono for building insurance in San Diego?

With over 50 years of experience, our family-owned agency has earned the trust of San Diego and Chula Vista clients. We combine superior service, practical insurance solutions, and a time-tested approach to property protection.

6. Is Hoffman Hanono licensed to provide insurance in California?

Yes. Our California insurance license number is 0424824, ensuring clients work with a fully licensed and compliant insurance provider.

7. How can I get a quote for building insurance?

You can request a quote directly on our website by clicking "Get a Quote," or contact our team via phone or email to discuss building insurance solutions for your property.

First-Class Service Since 1959

The story of our commercial insurance company starts with founder Jerry Hoffman, who aimed to offer cost-effective insurance solutions, superior customer service, and ultimately, peace of mind. Since then, the company has been passed down generations without losing our founder’s commitment.

Learn MorePeace of mind is priceless.

Let us help you get the right coverage for the right price.

Get a quote today!