Business Crime Insurance Coverage

What’s a good rule of thumb when it comes to your business? Hope for the best, but prepare for the worst. While companies take great care in hiring, striving to build teams of trustworthy professionals, sometimes a person with malicious intent slips into your organization.

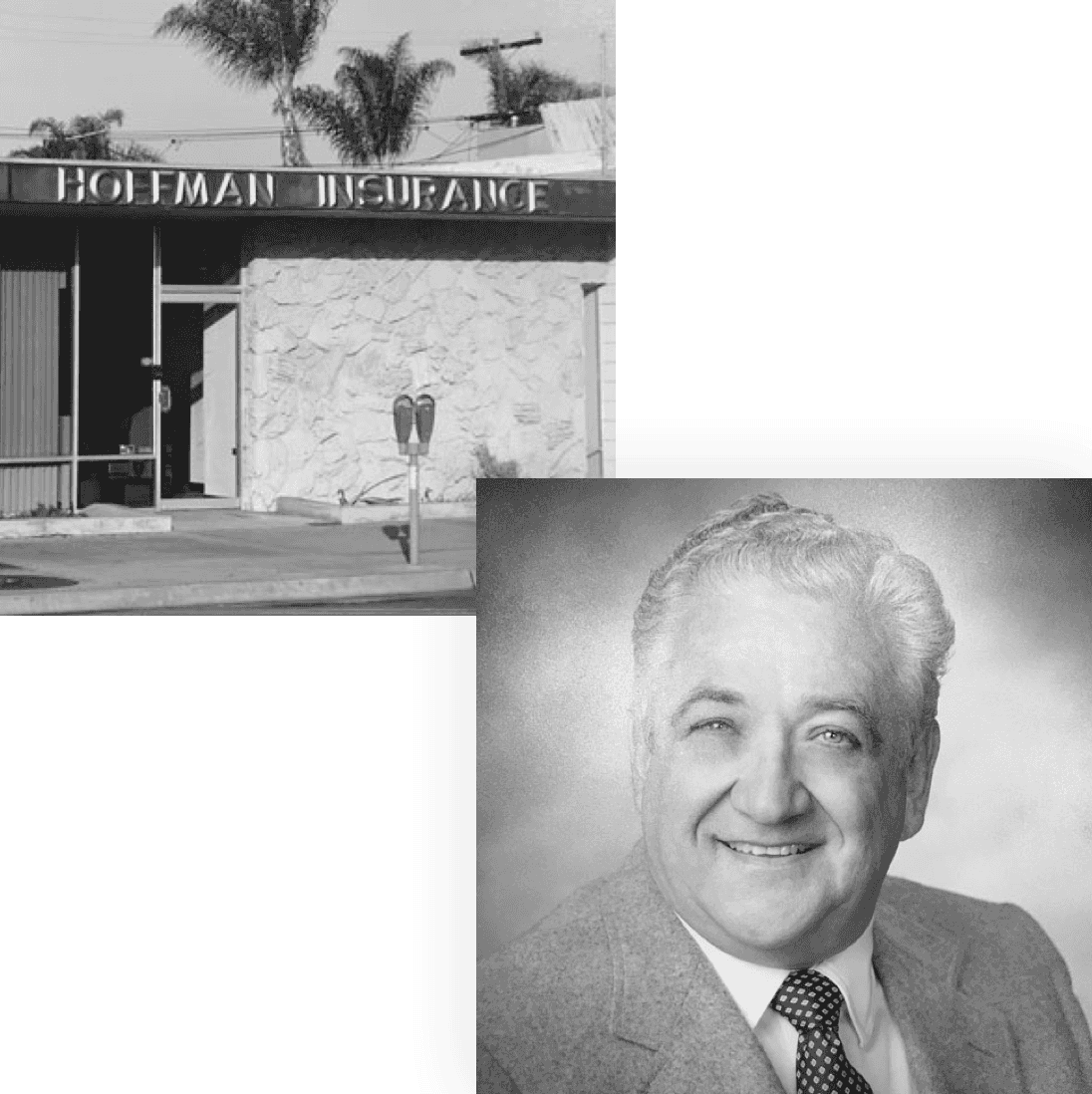

The best way to protect not only your business but the dedicated individuals you have in your employ is by obtaining a comprehensive crime insurance plan specific to your company and industry. Here at Hoffman Hanono, that’s just what we specialize in – crime insurance for businesses that offer protection now and long into the future.

What Is Crime Insurance?

Crime insurance is a particular type of insurance policy that protects a company from financial loss associated with a business-related crime. Policies can cover a range of situations but generally offer protection from direct losses that may arise from the following:

- Fraud

- Embezzlement

- Forgery

- Theft

- Burglary

- Dishonest acts from either employees or third parties

Custom Solutions

Our Crime Insurance Approach

At Hoffman Hanono, we’ve been helping people like you find financial security and peace of mind since 1959. If you need commercial crime insurance or other type of coverage, our agents can help.

We believe in more than just insurance sales. Our mission is to serve as advisers and partners as you explore the insurance landscape and choose the right protection for you. With us, you’ll find unmatched coverage at an unmatched price.

Trusted & Time-Tested Solutions

50+ Years Experience

Serving San Diego since 1959. We’re still family-owned and customer-focused.

All Lines of Insurance

We provide you with the most comprehensive coverage at a competitive cost.

Quality Service

We are dedicated to bringing you reliable and top-notch customer service.

Crime Insurance FAQs

1. What is business crime insurance and why do companies need it?

Business crime insurance protects your company from financial loss caused by illegal acts such as theft, fraud, forgery, or burglary. Even with careful hiring practices, dishonest behavior can happen unexpectedly, and a single incident can cost thousands of dollars. Crime insurance helps safeguard your business and your employees from the financial impact of criminal activity.

2. What does business crime insurance typically cover?

This coverage can protect your business against employee theft, fraud, embezzlement, burglary, forgery, cyber fraud, and dishonest acts committed by internal staff or outside third parties. Coverage varies depending on your industry and policy, so working with an insurance advisor ensures your plan fits your business risk.

3. Who should consider business crime insurance in California?

Any business that handles money, sensitive information, valuable inventory, financial transactions, or employee access to assets should consider crime insurance. It is especially important for retailers, financial service providers, manufacturers, contractors, transportation companies, and professional offices.

4. Does business crime insurance protect against crimes committed by employees?

Yes, many crime insurance policies include coverage for losses caused by employee dishonesty, including embezzlement, internal theft, and fraud. This protection helps businesses recover financially from crimes committed by individuals inside the organization.

5. Is business crime insurance the same as commercial property insurance?

No. Commercial property insurance generally covers physical damage such as fire, vandalism, or weather-related loss. Business crime insurance specifically protects against financial loss caused by criminal acts such as fraud, theft, or embezzlement. Many businesses need both for complete protection.

6. Why choose Hoffman Hanono Insurance for crime insurance coverage?

Hoffman Hanono has provided customized commercial insurance solutions in California since 1959. Their team designs crime insurance policies tailored to your industry, financial risk level, and internal operations. This ensures you receive strong protection at a competitive price backed by decades of trusted service.

7. How can I get a quote for business crime insurance?

You can request a quote online or contact Hoffman Hanono Insurance at (619) 420-1861 to speak directly with an advisor. They will review your business needs and recommend the right level of crime insurance protection.

First-Class Service Since 1959

The story of our commercial insurance company starts with founder Jerry Hoffman, who aimed to offer cost-effective insurance solutions, superior customer service, and ultimately, peace of mind. Since then, the company has been passed down generations without losing our founder’s commitment.

Learn MorePeace of mind is priceless.

Let us help you get the right coverage for the right price.

Get a quote today!